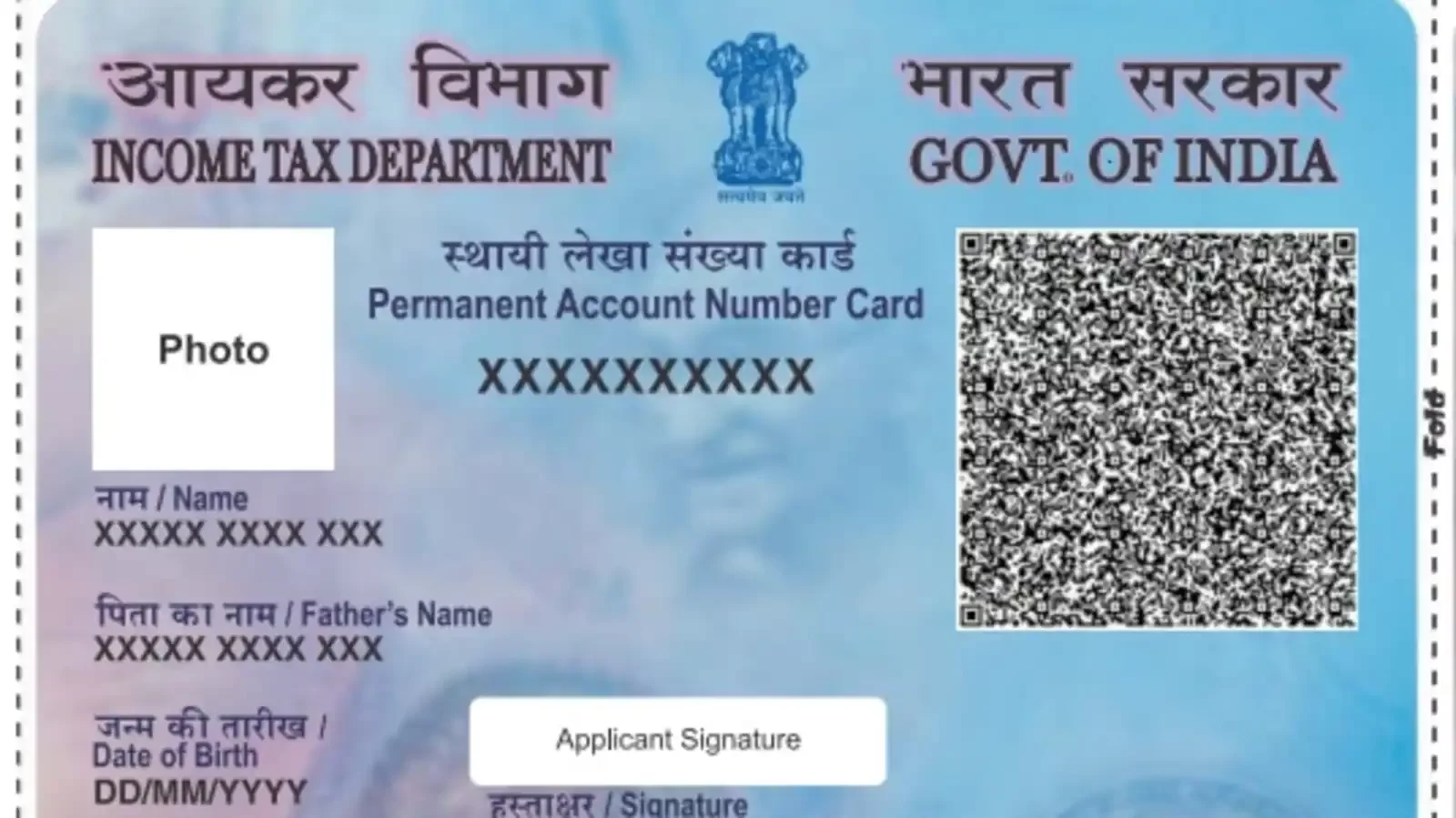

How to Obtain PAN/TAN

For new PAN, Indian citizens and NRIs (including companies, NGOs, partnership firms, local bodies, trusts, etc.) need to fill out Form 49A. Foreigners and foreign entities need to use Form 49AA. These forms and all the required PAN documents should be submitted to the Income Tax PAN Services Unit.

How to Apply of TAN?

Applicants can apply for a new TAN either by applying online or by visiting any of the TIN facilitation centres of Protean eGov Technologies Limited.

To apply online for a new TAN, applicants can follow the steps mentioned below:

- Visit www.tin-nsdl.com/index.html

- Select ‘TAN‘ under the ‘Services’ dropdown

- Click on ‘Apply Online’

- Select ‘New TAN’

- On the new page, choose from the list ‘category of ‘deductors‘ and click on ‘Select’.

- In doing so, you are redirected to Form 49B.

- Fill in the form and click ‘Submit‘